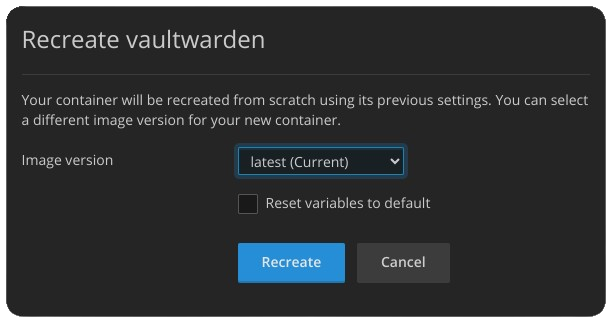

Docker > Settings > Overview > Recreate, making sure that “Reset variable to default” is not checked.

Finally start.

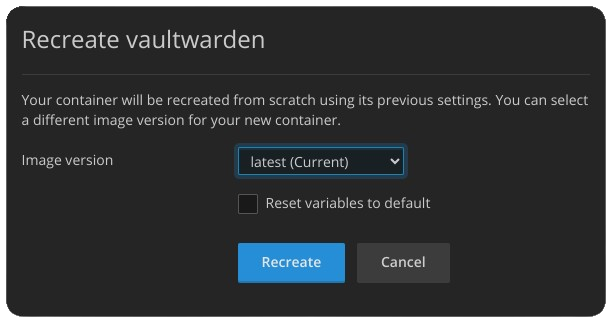

Docker > Settings > Overview > Recreate, making sure that “Reset variable to default” is not checked.

Finally start.

Tarbat Discovery Centre requested a new website for their Discovery Centre at the start of the year, which is now deployed!

Working closely with a designer was a great experience and the charity are pleased with the result.

Avoiding complexity and using hosted solutions minimise maintenance and training for the charity, allowing them to focus on their core mission.

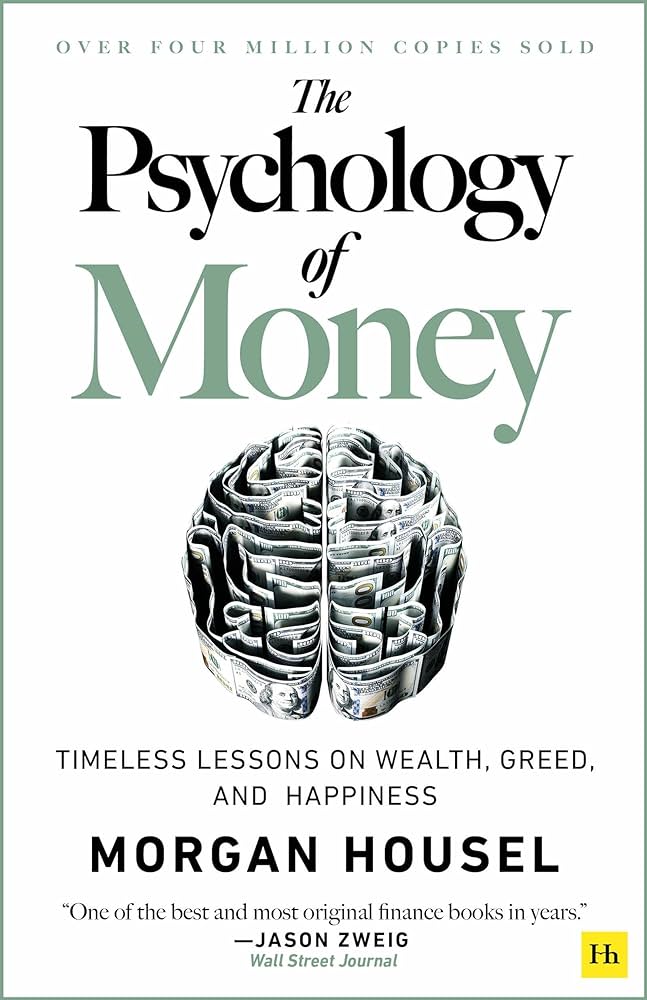

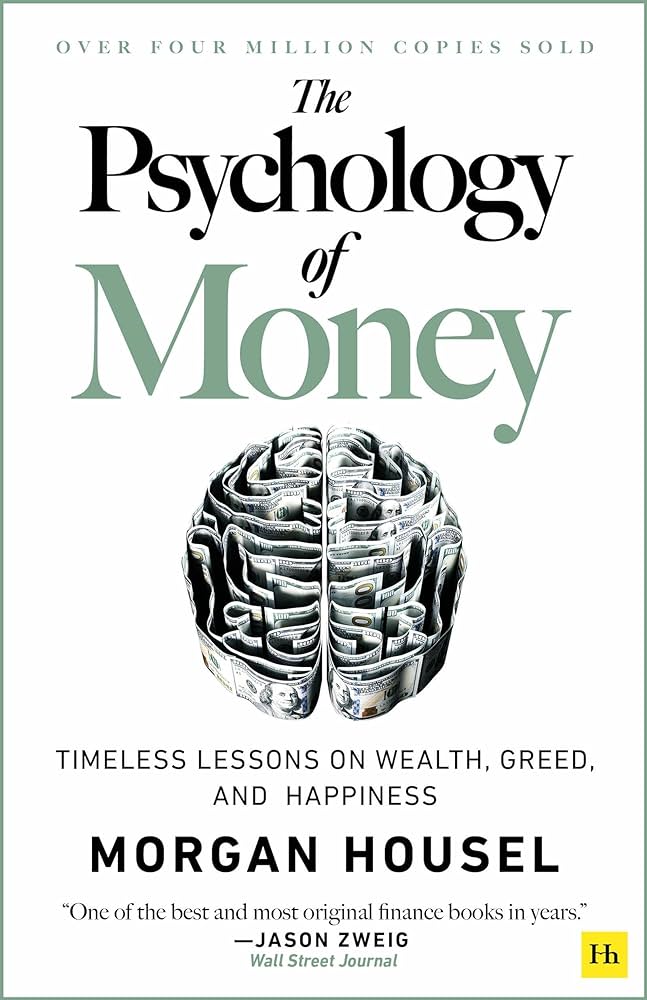

The Psychology of Money by Morgan Housel is a captivating exploration of financial decision-making through the lenses of history and psychology. Here are five takeaways from the book:

The Psychology of Money emphasises that financial well-being is not just about numbers; it’s about understanding ourselves, managing emotions, and making thoughtful choices.